Asia Pacific Electrical Bushing Market Introduction and Overview

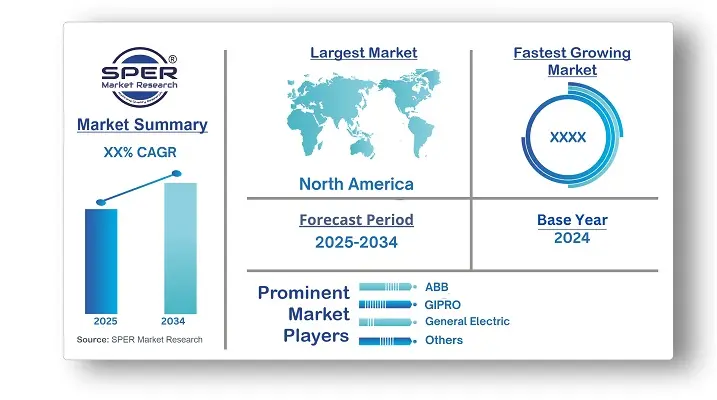

According to SPER Market Research, the Asia Pacific Electrical Bushing Market is estimated to reach USD XX million by 2034 with a CAGR of XX%.

The report includes an in-depth analysis of the Asia Pacific Electrical Bushing Market, including market size and trends, product mix, Applications, and supplier analysis. The Asia Pacific Electrical Bushing Market was estimated to be worth USD 1.7 billion in 2024 and is projected to expand at a compound annual growth rate (CAGR) of more than 6.28% between 2025 and 2034. The region's rapid urbanisation and industrialisation are raising demand for energy, which in turn is raising demand for electrical infrastructure, such as transformers and switchgear, of which electrical bushings are essential parts. Furthermore, the market for electrical bushings is expanding due to the growing renewable energy industry, especially in nations like China and India, as these are essential for effective power transmission from renewable sources.

By Bushing Type Insights

Oil impregnated paper (OIP) is expected to lead the market in 2024 based on bushing type because of its shown dependability and efficiency in high-voltage applications. Excellent insulation qualities, effective heat dissipation, and a long service life are all provided by OIP bushings. The requirement for OIP bushings is anticipated to grow as the Asia Pacific region's need for dependable electrical transmission and distribution infrastructure rises, especially in rising nations.

By Insulation Insights

Based on insulation, the polymeric segment is expected to have the highest CAGR through 2034 due to its lightweight, high mechanical strength, and resilience to environmental variables such as pollution and UV radiation. These features make polymeric bushings excellent for use in the region's tough operating circumstances, resulting in widespread adoption and a substantial market share.

Regional Insights

China's electrical bushing market was dominated in 2024 due to huge infrastructure development projects and rapid urbanisation. As the region's largest consumer of electrical power, China generates significant demand for electrical bushings at various voltage levels. Furthermore, the country's emphasis on modernising its power transmission and distribution networks to satisfy rising energy demand strengthens its position in the regional bushing market.

Market Competitive Landscape

The Asia-Pacific electrical bushing market is extremely competitive, with both global and local competitors. The market is characterised by fierce rivalry, technical developments, and product innovation. Key market participants include ABB Ltd., Siemens AG, General Electric Company, Toshiba Corporation, among others. These organisations rely on strategic collaborations, acquisitions, and new product releases to strengthen their market position and meet changing client expectations.

Recent Developments:

In September 2023, CG Power, part of the Murugappa Group, announced plans to expand its capacity at several facilities due to a rise in orders in the second quarter of 2023. This includes improving manufacturing for instrument transformers and condenser bushings in Nashik, and boosting production for large industrial machine units in Mandideep.

In April 2023, Eaton announced the successful acquisition of a segment of Jiangsu Ryan Electrical Co. Ltd., a company known for power distribution systems and sub-transmission transformers. This decision strengthens Eaton's global presence and position in energy, utility, and industrial sectors.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Bushing Type, By Insulation, By Voltage, By Application, By End User |

| Regions covered | Australia, China, India, Japan, South Korea, Rest of Asia-Pacific |

| Companies Covered | ABB, Barberi Rubinetterie Industriali S.r.l, CG Power and Industrial Solutions, Elliot Industries, Eaton, GIPRO, General Electric, Hubbell, Hitachi Energy, Jiangxi Johnson Electric Co., Ltd, Liyond, Nexans. |

Key Topics Covered in the Report

- Asia Pacific Electrical Bushing Market Size (FY’2021-FY’2034)

- Overview of Asia Pacific Electrical Bushing Market

- Segmentation of Asia Pacific Electrical Bushing Market By Bushing Type (Oil Impregnated Paper, Resin Impregnated Paper)

- Segmentation of Asia Pacific Electrical Bushing Market By Insulation (Porcelain, Polymeric, Glass)

- Segmentation of Asia Pacific Electrical Bushing Market By Voltage (Medium voltage, High voltage, Extra high voltage)

- Segmentation of Asia Pacific Electrical Bushing Market By Application (Transformer, Switchgear, Others)

- Segmentation of Asia Pacific Electrical Bushing Market By End User (Industries, Utility, Others)

- Statistical Snap of Asia Pacific Electrical Bushing Market

- Expansion Analysis of Asia Pacific Electrical Bushing Market

- Problems and Obstacles in Asia Pacific Electrical Bushing Market

- Competitive Landscape in the Asia Pacific Electrical Bushing Market

- Details on Current Investment in Asia Pacific Electrical Bushing Market

- Competitive Analysis of Asia Pacific Electrical Bushing Market

- Prominent Players in the Asia Pacific Electrical Bushing Market

- SWOT Analysis of Asia Pacific Electrical Bushing Market

- Asia Pacific Electrical Bushing Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Asia Pacific Electrical Bushing Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Asia Pacific Electrical Bushing Market

7. Asia Pacific Electrical Bushing Market, By Bushing Type (USD Million) 2021-2034

7.1. Oil impregnated paper (OIP)

7.1.1. Mineral-based

7.1.2. Silicon-based

7.1.3. Others

7.2. Resin impregnated paper (RIP)

7.3. Others

8. Asia Pacific Electrical Bushing Market, By Insulation (USD Million) 2021-2034

8.1. Porcelain

8.2. Polymeric

8.3. Glass

9. Asia Pacific Electrical Bushing Market, By Voltage (USD Million) 2021-2034

9.1. Medium voltage

9.2. High voltage

9.3. Extra high voltage

10. Asia Pacific Electrical Bushing Market, By Application (USD Million) 2021-2034

10.1. Transformer

10.2. Switchgear

10.3. Others

11. Asia Pacific Electrical Bushing Market, By End User (USD Million) 2021-2034

11.1. Industries

11.2. Utility

11.3. Others

12. Asia Pacific Electrical Bushing Market, (USD Million) 2021-2034

12.1. Asia Pacific Electrical Bushing Market Size and Market Share

13. Asia Pacific Electrical Bushing Market, By Region, (USD Million) 2021-2034

13.1. Australia

13.2. China

13.3. India

13.4. Japan

13.5. South Korea

13.6. Rest of Asia-Pacific

14. Company Profile

14.1. ABB

14.1.1. Company details

14.1.2. Financial outlook

14.1.3. Product summary

14.1.4. Recent developments

14.2. Barberi Rubinetterie Industriali S.r.l.

14.2.1. Company details

14.2.2. Financial outlook

14.2.3. Product summary

14.2.4. Recent developments

14.3. CG Power and Industrial Solutions

14.3.1. Company details

14.3.2. Financial outlook

14.3.3. Product summary

14.3.4. Recent developments

14.4. Elliot Industries

14.4.1. Company details

14.4.2. Financial outlook

14.4.3. Product summary

14.4.4. Recent developments

14.5. Eaton

14.5.1. Company details

14.5.2. Financial outlook

14.5.3. Product summary

14.5.4. Recent developments

14.6. GIPRO

14.6.1. Company details

14.6.2. Financial outlook

14.6.3. Product summary

14.6.4. Recent developments

14.7. General Electric

14.7.1. Company details

14.7.2. Financial outlook

14.7.3. Product summary

14.7.4. Recent developments

14.8. Hubbell

14.8.1. Company details

14.8.2. Financial outlook

14.8.3. Product summary

14.8.4. Recent developments

14.9. Hitachi Energy

14.9.1. Company details

14.9.2. Financial outlook

14.9.3. Product summary

14.9.4. Recent developments

14.10. Jiangxi Johnson Electric Co., Ltd

14.10.1. Company details

14.10.2. Financial outlook

14.10.3. Product summary

14.10.4. Recent developments

14.11. Liyond

14.11.1. Company details

14.11.2. Financial outlook

14.11.3. Product summary

14.11.4. Recent developments

14.12. Nexans

14.12.1. Company details

14.12.2. Financial outlook

14.12.3. Product summary

14.12.4. Recent developments

14.13. Others

15. Conclusion

16. List of Abbreviations

17. Reference Links